Welcome to 2016 where the only thing hotter than this winter is the private aviation market! While it is true that the weather has been fairer than normal, it is nothing compared to the aviation marketplace. Only 8 years ago, the industry was drowning in a rapidly expanding used aircraft market. The truth is that this industry collapse had its founding in the charter industry. As thousands of real estate salesmen made brand new careers out of the housing bubble, they could not help but spend that money in the most luxurious of manners, the private jet. However, many of them were not quite ready to place down the big investments on their own jets and ended up chartering relentlessly.

This type of extravagance is best portrayed inside of the movie The Big Short. When you see the realtors of America living absolutely extravagant lives, you get to see exactly how ridiculous the lifestyles had become. What this resulted in was a humongous swing of charter brokers into the black around the world. This prophet increases led to the snatching up of every available hour and nearly every aircraft. Owners for the first time in their lives were finding they were actually making a profit off of their private aircraft.

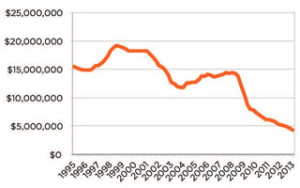

This led to many different owners upgrading to aircraft a previously could not have afforded, selling the aircraft that they could have afforded, and becoming accustomed to this new lifestyle. How this affected the aviation market, is still unclear to this day. However it is best represented inside of the graph of the price of very large jets as seen throughout the middle 2000’s to the 2010’s.

These years represent a humongous and unique change from what would be expected. The expected results of depreciation of aircraft is a steady, nearly linear fall. This value usually covers at a slope of -2 .5% or a grade of 25. This 25 grade slope is unanimous since the boom of modern aviation. A change from the slope with only occur during extremely unique financial situations.

In the years leading up to 2008 we see such a change. There is an actual increase in the value of many aircraft! That has been unheard of since Kitty Hawk! To connect the dots, the increase in value of jets represents that the humongous changes that occurred in the economy as a new charter interests enter the market and owners found a bigger market for their used aircraft. This was obviously not a sustainable system as the world would soon find soon find out. When this new middle class citizen who was finding themselves with a large influx of cash was decimated by the real estate burst, they found themselves stuck with thousands of dollars of mortgage debt that they could not afford.

If you amplify this on the on the scale of the also hurting large businesses who were not able to pay the mortgage is on their multi-million dollar jets they had a newly acquired it, you can see the effect ripple greatly. The owners who had now committed to these aircraft could not afford them as their new investments were losing billions of dollars. The first expense they cut was the jet. At the same time, the charterers who would come to rely on these increased profits for the lifestyle were finding themselves inside of a variety of debt maybe even their own real estate debt.

This amplifies dramatically as you can see with the graph of very heavy jets. It showed a humongous decrease in value over the following years. As used or short sale jets flooded the marketplace, there was almost no gain in buyers.

Usually inside of normal market as depreciation falls as the number of buyers will increase. However through the years 2008 all the way up in 2014 this pattern was not followed. Instead we see a complete degradation of the aviation marketplace with an increase of the 2.5% grade all the way up to nearly 60% grade that is a factor of almost 30. Across the board people are not making money on their planes and were now losing humongous portions of their brand new investment to depreciation. Even though much of this that could be written off as tax losses, it still did not justify or rectify the situation for the owners. Many of them still want to dump this bad investment before it got worse which led to a complete unglueing of the market.

As the market fell apart, many of the smaller manufacturers had to hit the brakes on major developments. We saw the fall of the Hawker company, the buyout of BGeechjet, Cesna’s uniformation of the different aircraft, and many other changes within the Boeing Company. This however is still only representative of greater changes that have occurred. Today the market is once again stabilizing and has come back from the horrible 60% grade to a more stabilized with 3% grade depreciation value. This has again made it safe to buy aircraft at expected rate and has allowed for the marketplace to stabilize.